rental income tax malaysia

This is after EPF. Hence it is important for property investors to understand the actual taxation on rental income before they start to.

Property Tax In Malaysia Real Estate Glossary Malaysia Property Property For Sale And Rent In Kuala Lumpur Kuala Lumpur Property Navi

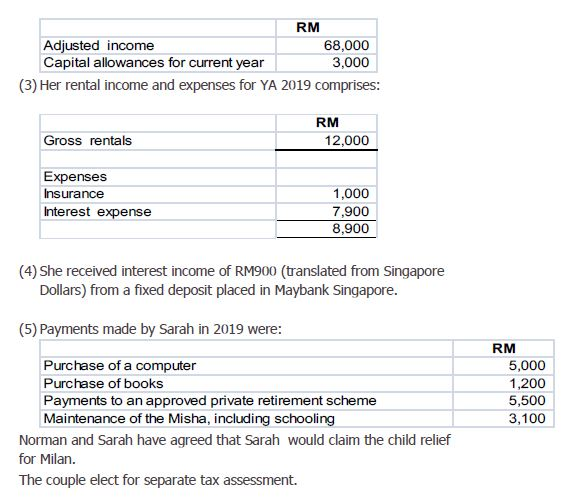

What is the taxation of rental income in Malaysia.

. The amount of income you earn exceeds RM34000 per Annum and if you break it down to per month around RM283333. Now in 2019 the time has come for property owners. The Malaysian Inland Revenue Board issued a set of updated frequently asked questions FAQs on the special tax deduction available for landlords that.

Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ITA. Azrie owns 2 units of apartment and lets out those units. In order to promote affordable.

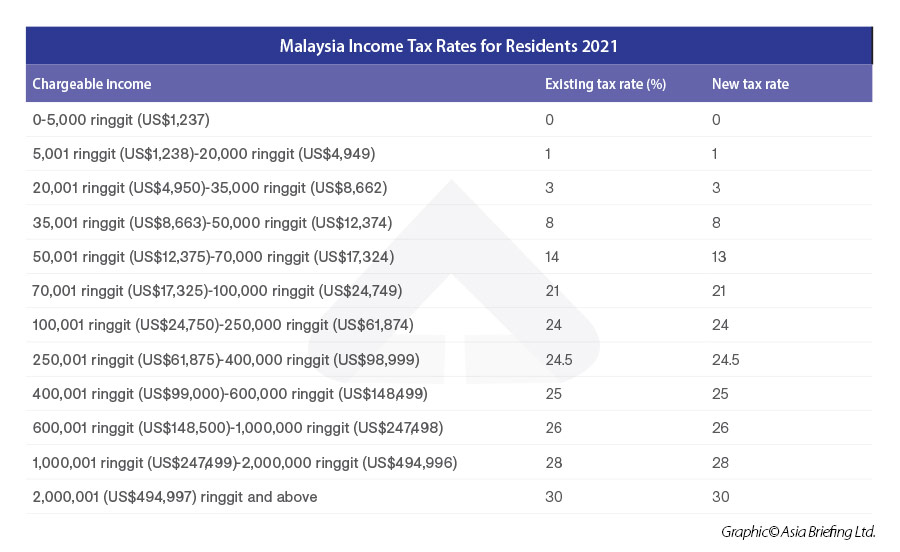

It is also calculated on a net basis where all. In Budget 2018 the government introduced a new limited time tax exemption designed to control home rental prices. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30.

Set under a separate category rental income tax comes with its own progressive tax rates that range between 0 and 30. Rental income in Malaysia is taxed at a progressive rate ranging from 0 to 28 percent depending on the amount earned. Prior to Jan 1 2018 all rental income was assessed on a progressive tax rate ranging from 0 to 28 without any tax incentive or exemption.

The government of Malaysia is offering 50 income tax exemptions for three consecutive years 2018 2020 to individuals who rent out their residential properties at a rate not exceeding. According to Thannees Tax Consulting Services Sdn Bhd managing director SM. March 1 2021.

The deduction applies to rental of premises for business premises only. However those rental income are taxable based on Malaysia Taxation Law. To legislate the proposals the following Rules were gazetted on 8 September 2021.

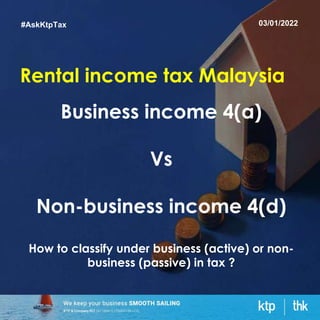

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Whats the income tax on residential lettings in Malaysia. Rental income is taxed at a flat rate of 24.

For the first RM 20000 tax to pay is RM 475. The tax levied on the average annual income on a rental apartmentproperty in the country. Nonresidents are taxed at a flat rate of 24 on their Malaysian-sourced income.

If property repairs cost RM5000 quit rent is RM50 and assessment tax is RM500 then net rental income is calculated as below. Discover how much a foreign landlord earning rent will actually pay using worked examples. For the resident the tax rate will be.

Income tax on rent. You will only need to pay tax if. Rental income taxes.

Gross rental income is US1500month. For every RM 1 above will be 7 tax to pay is RM. RM2000 x 12 RM500 RM50 RM5000.

Tax chargeable on the rental Income will be.

German Rental Income Tax How Much Property Tax Do I Have To Pay

5 Tax Considerations When Selling Off Your Property Iproperty Com My

Psvs 53 How To File Your Taxes For Rental Income Malaysian Context Youtube

Features Of The Chinese Personal Annual Income Tax Settlement Rodl Partner

Malaysia Bracing For Taxation Of Foreign Sourced Income

Real Property Gains Tax Rpgt In Malaysia 2022

Malaysia Personal Income Tax Guide 2020 Ya 2019

Individual Income Tax Amendments In Malaysia For 2021

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

German Rental Income Tax How Much Property Tax Do I Have To Pay

Bursa Dummy Tax On Rental Income

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

All About Taxes On Rental Income Smartasset

Avoiding Rental Income Tax Pitfalls In Malaysia

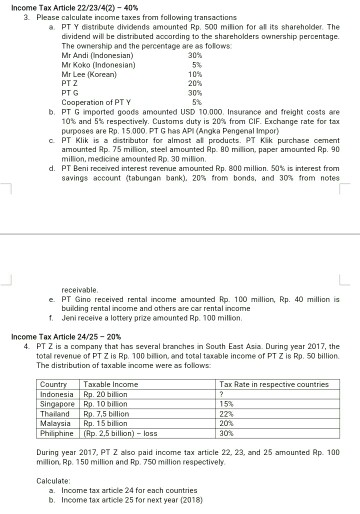

Income Tax Article 22 23 4 2 40 3 Please Calculate Chegg Com

Malaysia Tax Case Rental Income

Rental Income Tax Malaysia 2019 Madalynngwf

0 Response to "rental income tax malaysia"

Post a Comment